Awach SACCO is a saving and credit cooperative that operates in the financial sector of Ethiopia. The organization was established on March 22, 2007 by Mr. Zerihun Sheleme and 41 initial members. Since then, it has been providing a variety of financial services to its members. Awach SACCO aims in promoting financial inclusion and improving the economic well-being of its members and the communities it serves. The company’s primary purpose is to encourage a saving culture and loan provision in the community. Additionally, the organization facilitates credit to its members with a competitive interest rate.

Through this effort, Awach SACCO has helped many entrepreneurs grow their businesses and improve their standards of living. Accordingly, Awach has been certified as competent SACCOS, based on Regulation No. 018/2007, after scoring 81.65 points in the competency evaluation.

- Location: Aware around Edna Addis Hotel at Agar Building (Head Office); Mexico Hebert Bank Building Head Office (Main Office)

- Po. Box: 34752, Addis Ababa, Ethiopia

- Tel: +251-118-12-44-44, +251-944-69-69-69

Awach provides different financial services, including savings, loans, and training and consultancy, to its members. These services are designed to meet the unique needs of each member. Awach has a strong commitment to promoting financial inclusion and economic empowerment in the communities it serves. As a result, many individuals and small businesses have been able to access the resources they need to thrive and succeed. Here is an explanation of each of the three main services the organization offers: savings, loans, and training & consultancy.

Savings

Awach provides different types of savings accounts to cater to the diverse needs of its clients. In terms of loans, Awach offers various options with flexible repayment terms and competitive interest rates.

Compulsory Saving

Each cooperative member must contribute Br. 500 or 10% of their monthly income, on a regular basis. These savings could only be withdrawn when the membership is cancelled.

Voluntary Saving

A cooperative member can voluntarily save any amount of money and could withdraw it anytime.

House Saving

To purchase, build, or maintain a home, a member saves and borrows money. A member could borrow up to 3,000,000 Ethiopian birr as a house loan.

Automobile Saving

A member could save for a car loan. A member could borrow up to 1,500,000 Ethiopian birr to buy an automobile.

Transport Car Saving

A member could borrow and save up to 2,000,000 Ethiopian Birr to purchase a business vehicle.

Business Saving

To launch or grow a business, a member could save up to 800,000 birr and borrow up to that amount.

Social Saving

To begin or grow a social loan, a member could save up to 600,000 birr and borrow up to that amount.

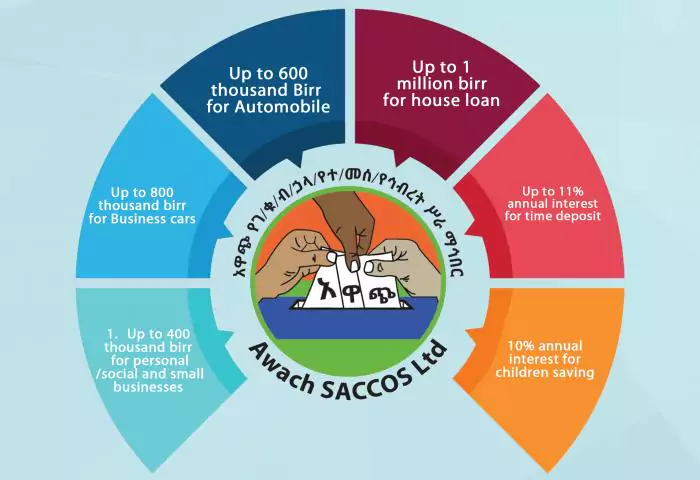

Saving Interest

Awach SACCO members receive 7% annual savings interest on their account deposits.

Children Saving

Awach SACCO not only encourages saving but also teaches parents and kids responsible money management. Furthemore, children can save money in the Awach SACCO without any restrictions or guidelines through their parents or legal guardians.

Related Articles

- Top 10 Banks in Ethiopia

- How to Use CBE Birr | Step by Step Guide

- How to Make Money Online in Ethiopia

Loan service

The other main activity in the Awach SACCOS is the provision of loans and credit. Everyone who is a member has an equal right to use the credit service. Before approving each credit application, Awach’s loan committee and loan department consider the following factors in addition to whether the pre-credit requirements in the bylaw have been met. It is obvious that segregation of duties is necessary during the loan approval process because, after the loan committee approves a particular case, the board chairman and finance manager must approve the request before any payment can be made.

Requirements To Get a Loan

- The member must consistently save for at least six months in a row, which equates to 25% of the requested or required loan amount. The pre-loan saving amount will be 30% of the total loan amount if the loan is being used to launch or grow a business.

- A member must save for at least a year before applying for a home or car loan. The pre-loan saving for a house loan is 25% a vehicle.

- should bring a letter from her/his employer stating the member’s monthly income.

- Business owners need to bring their renewed trade license and a cash flow statement showing their monthly cash flow.

- Should bring a guarantee for the loan.

- Should bring one member from the cooperative as a guarantee. Should be willing to pay a 1% service charge and 1% insurance.

- Should be willing to pay 1% service charge and 1% insurance.

How Much Credit Can I Get?

- A member could take up to 600,000 Ethiopian birr loans for social purposes, health, and education.

- A member could take up to 800,000 Ethiopian birr loan to start or expand a business.

- A member could take up to 2,000,000 Ethiopian birr loan to buy a car for business.

- A member could take up to 1,500,000 Ethiopian birr loan to purchase an automobile.

- A member could take up to 3,000,000 Ethiopian Birr to buy, construct, or maintain a house.

Loan Interest

The loan interest rate for social, health, and education loans is 13% per year for women and 13.5% per year for men; 14.5% per year for automobile loans; and 15.5% per year for a house loan.

Training and Consultancy

Awach SACCOS offers training to its members on a variety of subjects, including the history of cooperative development, the development of Awach SACCOS, and entrepreneurship and small business.

Related Articles

0 Comments